Who would use the CRISPTM Score?

Why Does Climatekk Matter?

In order to solve a problem, both understanding and clearly communicating the problem are the first step in coming to a solution. Knowing the issues that an organization faces, in a concise and clear manner, is the keystone of the solution. In other words, you cannot manage and/or report on what you cannot measure and quantify. Organizations who use Climatekk and their CRISPTM Scoring capabilities, (Climate Resiliency Index for a Sustainable Planet) provide entities the ability to tangibly measure and manage climate risk and move towards risk mitigation and resiliency.

The financial impact of climate change and climate resiliency as viewed against a companies TCO, ROI and compliance profiles are now under ever increasing focus and is further exacerbated by the requirements that external and internal stakeholders are bringing to bare in order to ensure fiscal and environmental stability. As told to CNN, “Climate change poses serious risks to the stability of the financial system” per a senior International Monetary Fund.

Managing for climate change means translating risks and opportunities into the right business language. Once climate-related risks and opportunities are translated into business financial terms, management teams can better justify new investments or strategies compatible with various climate futures.

How does CRISPTM help?

Climate change is no longer a question of environmental policy, it is a financial metric used to evaluate the resilience and wherewithal of an organization. In the United States, President Biden has instructed all federal agencies to consider the climate implications of their actions. Treasury Secretary Janet Yellen has called climate change an "existential threat" to the global financial system and an urgent concern for federal regulators.

According to some, current reporting of financial risk in financial markets is systematically underpricing the broad, systemic risks presented by global climate change. Others discount the value of more stringent climate disclosure requirements and question whether financial and securities regulators are in the best position to address climate-related concerns.

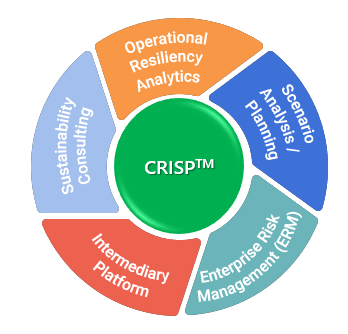

Using Climatekk and generating CRISPTM Scores, tangibly allows organizations to quantify risk and outline a prioritization strategy for the most impactful mitigation. The CRISPTM Score highlights areas of strength and weakness as well as, on an industry-by-industry basis, leverages all known quantification schema and criteria into a central repository of truth and effort, saving time, cost and ensuring compliance and accuracy. The CRISPTM score will provide a listing of actionable outcomes that can be used to improve resiliency and financial standing.

What is the Climatekk Methodology-QUASARTM?

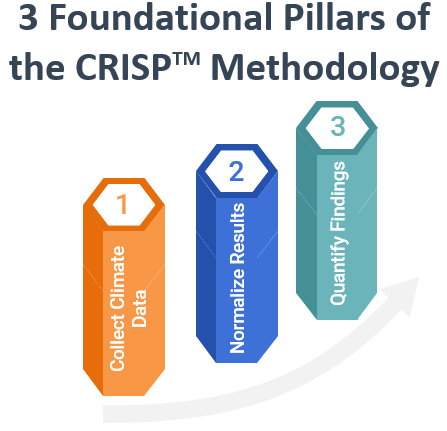

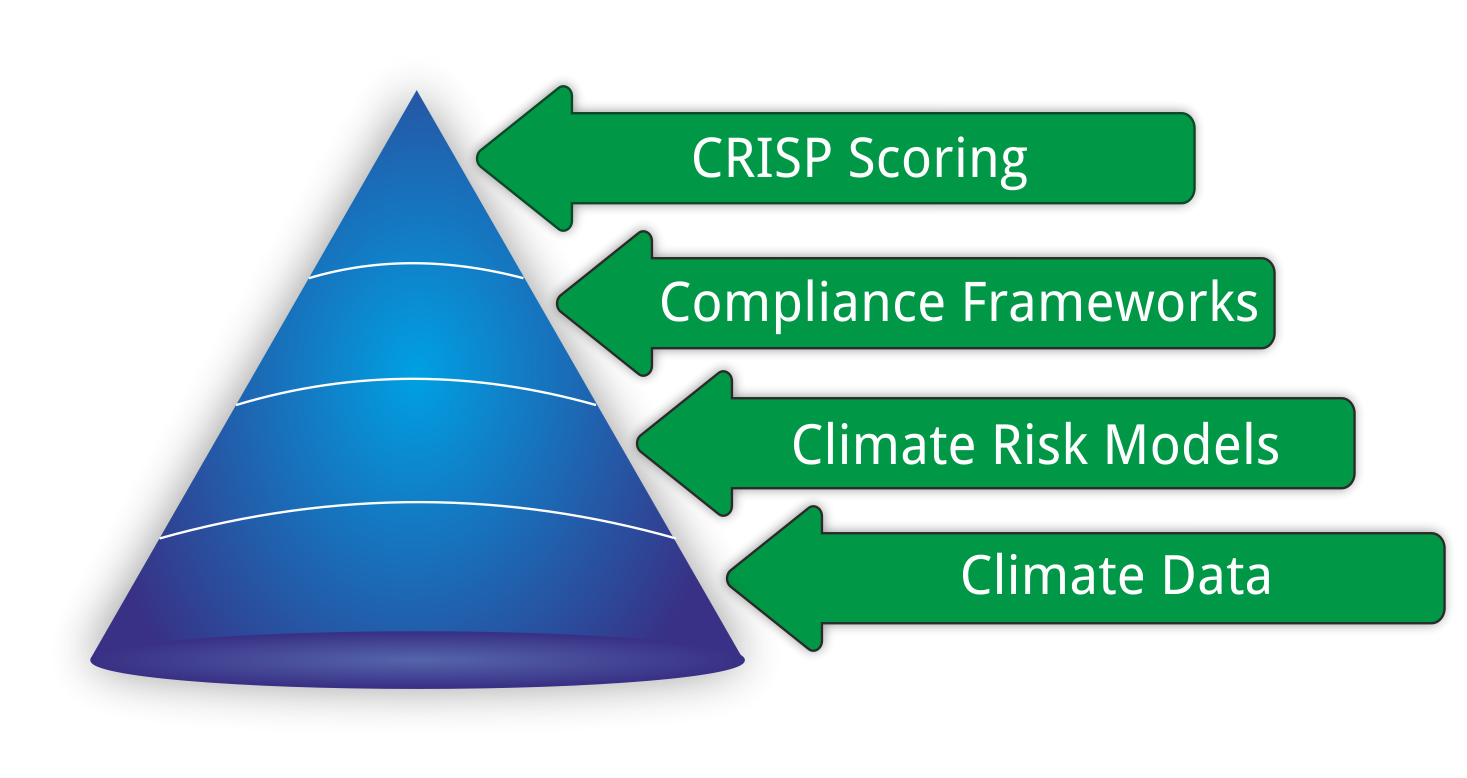

Climatekk, using the CRISPTM framework, provides a toolset that measures and manages current and future states of financial climate resiliency for organizations. The Climatekk CRISPTM Model uses 3 Pillars as the foundation of analysis. These pillars include;

- Collection of climate data (both solicited and unsolicited data).

- Normalization of results, using the findings using both internal and external climate risk factors.

- Quantification of the findings, cross referenced with industry specific measurement criteria, Climate Risk data aligned with mitigation strategies to develop actionable plans and to help quantify and prioritize mitigation strategies to improve financial resilience based on climate dynamics.

At the core of all ClimatekkTM consulting is the use of Climatekk’sTM QUASARTM methodology which is based on the CRISPTM three pillars of operation, to Collect, Normalize and Quantify the climate risk data in order to develop actionable plans.

-

Once the CRISPTM Score is generated and all pertinent industry compliance scoring tools are

cross-referenced Climatekk consultants will work to:

- QUantify the Climate risk being addressed (platform)

- Complete the Climatekk Climate Analyzer tool

- Take the data and run it through the Climatekk Scenario Builder

- Develop Action / Optimization plan for resilience.

- Resilience Remediation programs that will be leverageable and available for quarterly review